nyc · usa · 2022

cosmetic pharmeceutical brand

consumer research

Role

Research Analyst

Team

4-person research + analytics team (strategy, analytics, primary research, health comms)

Methods

In-Depth Interviews (IDIs) among patients and healthcare practitioners (HCPs) + Social Listening Analysis

Project Overview

Everyone talks about "innovation" in aesthetics; patients scroll and end up down rabbit holes, injectors evaluate options, while brands vie for their attention. But what actually determines how brand choice innovation is embraced? How does one treatment get chosen over another? We set out to understand what healthcare practitioners (HCPs), who perform non-surgical cosmetic procedures, are actually drawn towards when it comes to innovating their practices and product selection. But we knew we couldn't just ask clinicians. We needed to hear from the patients who help guide practice decisions and the demand tide for these professionals every day. So we did both. Everything we learned went into building a workshop curriculum and a new analytics-backed engagement strategy for our cosmetic pharmaceutical client, along with an interactive dashboard.

I crafted the HCP discussion guide and drove the analysis for a mixed-methods study that tracked how these decisions really unfold, from clinic floor to the digital trace of what people search for online.

Motivation

Trying to break into an already dominated, yet rapidly shifting category with younger consumers entering earlier, our cosmetic pharmaceutical client needed to understand why HCPs adopt (or resist) new products, and what a new generation of patients actually value that would inspire customer loyalty.

Key Research Questions

01

Motivation to Innovate

What motivates HCPs to try, adopt, and keep a new product into their practice, and what gets in the way?

INTERVIEWS

02

The Makings of Product Open-Mindedness

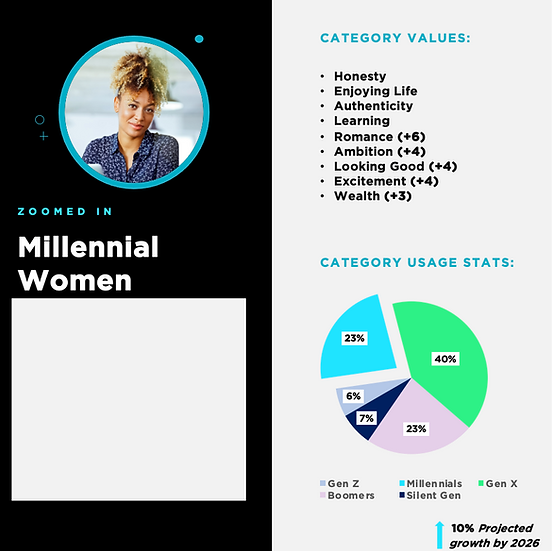

How do patients (with a focus on Millennial women) discover, evaluate, and decide on a product and how do injectors influence brand choice? (Interviews)

INTERVIEWS

03

Longevity x Price x Novelty x Luxury Interactions

Where do longevity, price, and novelty/luxury cues actually matter in real decisions? (Social Listening Analysis + Interviews)

SOCIAL LISTENING ANALYSIS + INTERVIEWS

04

Vital Metrics, KPIs, and Education Levers

What metrics / KPIs / education levers will help reduce misinformation and be essential to building trust and retention across both audiences? (Social Listening Analysis + Interviews)

SOCIAL LISTENING ANALYSIS + INTERVIEWS

Key Research Questions

Methods

The methodology was designed to triangulate data across providers, patients, and open public discourse on three social platforms.

In-depth Interviews (Clinicians)

MDs (n=8); NPs/Aestheticians (n=10). Professionals recruited across different practice types and patient volumes. Sample segmented by patient type:

-

Traditionalists / risk-averse / loyalists (n=5)

-

Moderate Pragmatists (n=8)

-

Innovators / Early Adopters (n=5).

APPROACH

We conducted one-on-one IDIs to understand how HCPs make adoption decisions for new product brands. We probed mostly for stories of how they came to accept the current brands used in their practice today.

Discussions explored how they first learn about them, what prompts a trial, and how they judge performance. We discussed their frameworks for how product “innovation” is approached in practice and what factors matter most in that process, (e.g., clinical data, patient experience, brand reputation, economics etc.).

We also examined which constraints influence their openness to switching from one product to another. Finally, we probed about what HCPs expect from manufacturers themselves across the adoption journey.

RATIONALE

We chose interviews to uncover adoption attitudes invisible in survey data. HCPs operate in nuanced ecosystems built around evidence, their reputations , and patient trust. Conversation and stories allowed us to observe their reasoning and perceptions and understand more of the cultural textures of their practice. It also filled in some blanks in our client’s knowledge about their positioning in the B2B market.

.png)

Methods

In-Depth Interviews (Patients)

(n=8); Gen X (n=4); Younger Boomers (n=3).

APPROACH

We probed for patient journeys and stories with cosmetic treatments, especially what the customer journey from discovery through long-term patient loyalty and advocacy looks like. We listened for stories of events that triggered a brand switch and what emotions and beliefs shape trust and risk perceptions of brands, procedures, and doctors.

We used behavioral prompts (e.g., “Walk me through your last booking decision step by step”) and scenario questions to surface beyond what they say they value by distilling the shortcuts and trade-offs we identify in their actual behaviors.

RATIONALE

We aimed to capture the lived experience of patients and understand how they interpret efficacy, safety, and value.

Social Listening Analysis

3 social media platforms: Reddit, Real Self, X, and Instagram.

APPROACH

Monitored spontaneous discourse and associations surrounding our client’s brand among other brands in our client’s category in open forums and social channels.

We also wanted to know which unmet informational needs and misconceptions surface most often, and which narratives dominate in the categories of efficacy, safety, price, and novelty.

RATIONALE

We used social listening to supplement interview findings, as we did not want to waste too much interview time on discussions around brand classification and associations. These types of conversations would ideally be captured in a survey. Since a survey was not in the budget for this research, social listening activities served as an efficient replacement, uncovering spontaneous discourse about brands in unprompted,, organically formed online environments.

Research Question 1: Motivation to Innovate

WHAT WE AIMED TO FIND OUT + RESEARCH DECISIONS

What does HCP adoption decisions hinge on? What do HCPs want to feel before committing to ordering and using new products in their practice? Where are the hesitations when transitioning to new products?

We decided we needed to understand the underlying needs of HCPs by examining stories of successful and unsuccessful brand experiences in their medical practices. These objectives are what we built our discussion guide around. We prompted HCPs to walk through their real decision moments in their adoption journey, from first exposure to abandonment or long-term use, probing for the emotional, practical, and institutional factors influencing those choices.

ANALYSIS AND OUTCOMES

-

We conducted affinity mapping, clustering, and distilling insights by impact, frequency, and spread amongst all participants and interview data overall, in order to get some high-level insights that were needed from a communication and strategy point of view. Having only granular insights had the potential to make the client feel pulled in too many contrasting directions or leave them without a north-star narrative or story.

-

To supplement the broader, top-line insights, we conducted line-by-line coding, segmenting responses by innovation orientation (innovators vs moderates vs. traditionalists). Themes were triangulated with digital and patient interview data to validate which adoption levers were most vital. This provided more granular insights that had the polarity to invoke new data-backed strategy, design, and communication decisions.

-

We distilled our findings into a framework for optimized HCP engagement based on HCP profile (innovator, moderate, traditionalist). This informed creative strategy around proof-driven storytelling, intuitive reporting structures, and clinical education models informed by learning design principles.

How We Solved Each Research Question

Research Question 2: The Makings of Product Open-Mindedness

WHAT WE AIMED TO FIND OUT + RESEARCH DECISIONS

We sought to understand how patients discover and decide which products they want or ask their injector for, as well as the factors that primarily inform their product choices. It was also important for us to identify the barriers to discovery and loyalty to a product brand, and how a patient becomes convinced to abandon their loyalty to one brand and try another.

To operationalize this question, we grounded interviews in past behaviors rather than asking participants to state preferences. We asked patients to recall how they first discovered products they had tried and are currently using, mapping specific touchpoints (e.g., social content, peer recommendations, injector conversations, brand exposure) and probing how each source felt (e.g., trustworthy, overwhelming, unclear, etc.). We then focused on discrete decision moments, asking participants to recount times they requested a product by name, deferred to their injector’s recommendation, or opted not to try something new, and probed for what they needed to feel at each moment to move forward.

To understand openness to switching, we used contrast-based probing, asking patients to describe brands they remained loyal to alongside moments they abandoned or reconsidered that loyalty, to uncover those breaking points and the proof required to justify their change. Throughout, we examined how injector recommendations were framed and interpreted, distinguishing guidance from persuasion, to clarify how trust in the injector shapes brand choice.

ANALYSIS AND OUTCOMES

-

We conducted an affinity mapping activity with all interview data overall

-

Top-line affinity mapping was followed by line-by-line coding data organized by each phase of the decision journey explored in the conversations:

-

Discovery → research → booking → in-clinic experience → post-treatment loyalty / switching

-

-

We utilized descriptive patterning (e.g., which touchpoints most often triggered anxiety vs. excitement).

-

We were sure to flag contradiction and tension points (e.g., “I’m scared of looking frozen, but I also want maximum effect”) to inform more realistic personas and messaging frameworks.

-

We cross-referenced themes with social listening data (e.g., the frequency of safety vs. promotion talk online) to see which patient concerns were idiosyncratic vs. widely shared.

-

We created a user persona based on patient interview data, existing market research, and digital analytics findings.

Research Question 3: Longevity x Price x Novelty x Luxury Interactions

WHAT WE AIMED TO FIND OUT + RESEARCH DECISIONS

Which factors are the non-negotiable benchmarks for patients when it comes to product loyalty, and which are contingent on other factors? How do patients define and perceive longevity and luxury? How does price factor into their perceptions of these definitions, and what does this say about how our target audience determines value in this product category?

Using social listening platforms Brandwatch and Sprout Social, the analysis included scraping comments, posts, and online discussions, while using cluster analysis to identify themes

Our multi-layered analytics framework included: volume & velocity (post frequency), cluster analysis (grouping co-occurring key terms across different brands), sentiment analysis (applying polarity scoring and manual validation to spot shifts from enthusiasm to skepticism), and narrative mapping.

ANALYSIS AND OUTCOMES

-

Using social listening platforms Brandwatch and Sprout Social, the analysis included scraping comments, posts, and online discussions, while using cluster analysis to identify themes. Findings were triangulated with interview insights.

-

I helped define scraping parameters, classify sources, and coded content for intent and sentiment, supplementing with simple frequency mapping to spot trend inflection points.

The project changed how the client understood and acted on their audiences. Our research team created measurable value by turning insights into tangible action points. We transformed qualitative understanding, and built upon some of the dense, misdirected client-owned market research data into an educational framework, engagement strategy, and a live dashboard that the client uses for ongoing decision-making.

By using mixed methods and translating complex behavioral patterns into clear strategies, we improved research, we connected emotional, behavioral, and contextual data to real business and design outcomes. It helped marketing, creative, and product teams unite around a more single source of truth.

Beyond the deliverables, the engagement highlighted how thorough research thinking ameliorates confusion in a consumer market with various actors with vastly different motivations and needs. We built a bespoke, scalable system for those highly customized insights to last and evolve, ensuring that informed authenticity and intimate consumer knowledge guide business strategy and communication in a space filled with misinformation and differentiation.

Research Question 4: Vital Metrics, KPIs, and Education Levers

WHAT WE AIMED TO FIND OUT + RESEARCH DECISIONS

Across interviews and social listening, what do patients and providers rely on when evaluating and learning about brands? What can the conversations reveal about gaps in education? How can we leverage the way information tends to circulate across word-of-mouth, forums, social platforms, and clinic interactions as an opportunity to identify the important metrics, KPIs, and education levers that are creating gaps and barriers to product adoption?

Digital observation showed that certain topics triggered recurring waves of confusion or debate, often influenced by how posts were framed rather than by clinical truth. These patterns highlighted how “trust” was not just a single, binary event but a cumulative behavior shaped by tone, timing, and the perceived authority of the source. Together, these insights pointed to the need for consistent educational touchpoints, and metrics that captured the quality of understanding and the stability of trust over time, beyond simple brand awareness.

Misinformation about certain treatments was rampant and clouded by promotional activity.

-

We coded digital conversations by topic, tone, source authority, and interaction pattern and tracked recurring moments of confusion, debate, and correction across platforms. We also compared organic educational exchanges against promotional or branded content

-

Educational Framework Deliverable: We designed a safe, credible educational system that tailored accessibility and authenticity to our audience segments.

-

New KPIs and Dashboard Deliverable: We defined customized indicators (provider confidence, message integrity, retention risk) to track how trust and confidence actually build. This resulted in an Interactive Dashboard designed to monitor misinformation trends in the client’s space.

Outcomes

CLOSING NOTE & CONTACT

This case study presents the polished outcomes of a pilot research initiative, but the process included iterations, messy data, and behind-the-scenes decisions that can’t all be captured here.

If you’d like to dive deeper into the challenges we faced, our sampling approach, and our discussion guide strategy, I’d be happy to walk you through the full story in an interview or live presentation.

Contact Information:

-

Email: isjbolar@gmail.com

-

LinkedIn: https://www.linkedin.com/in/isleybolar/